1QFY2018 Result Update | IT

July 28, 2017

HCL Technologies

BUY

CMP

`891

Performance Highlights

Target Price

`1,014

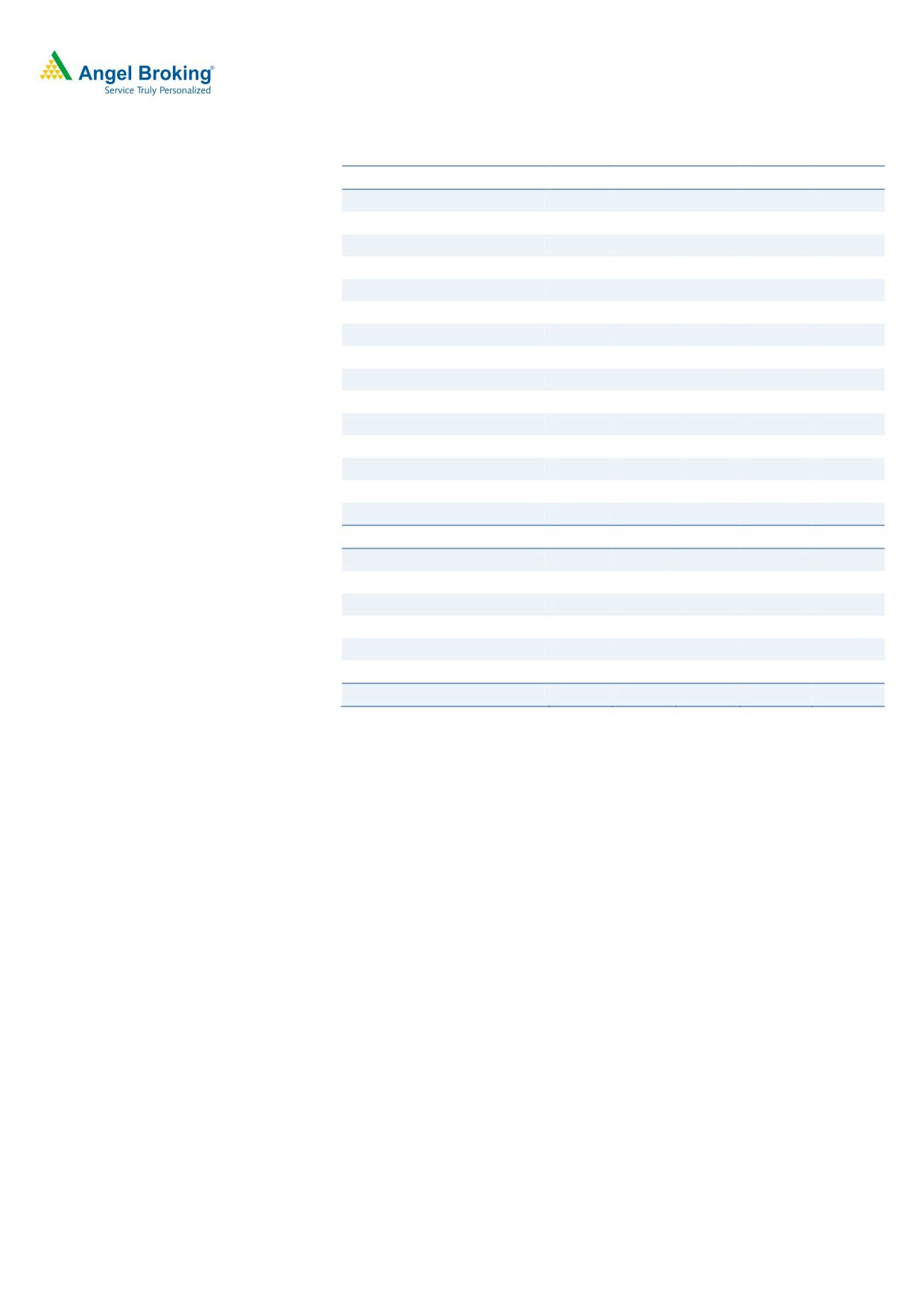

(` cr) - Consl.

1QFY18

4QFY17

% chg (qoq)

1QFY17

% chg (yoy)

Investment Period

12 Months

Net revenue

12,149

12,053

0.8

11,336

7.2

Stock Info

EBIT

2,445

2,416

1.2

2,333

4.8

EBIT margin (%)

20.1

20.0

8bp

20.6

(46)ps

Sector

IT

PAT

2,171

2,325

(6.6)

2,047

6.1

Market Cap (` cr)

1,27,209

Source: Company, Angel Research

Net Debt (` cr)

(12140)'

For 1QFY2018, HCL Tech posted results below expectations on sales front, while EBIT

Beta

0.4

and net profit came in higher than expected. The sales came in at US$1,884mn (v/s.

52 Week High / Low

910/731

US$1,891mn expected) v/s. US$1,817mn in 4QFY2017, a qoq growth of 3.7% qoq.

Avg. Daily Volume

1,44,465

Revenue in Constant Currency (CC) terms was up 2.6% qoq. The EBIT margin came in

Face Value (`)

2

at 20.1% (v/s. 19.5% expected) v/s. 20.0% in 4QFY2017, a qoq expansion of 8bps.

BSE Sensex

32,382

Thus, PAT came in at `2,171cr (v/s. `2,101cr expected) v/s. `2,325cr in 4QFY2017, a

Nifty

10,021

qoq dip of 6.6%. In terms of guidance, the company has re-iterated that FY2018

Reuters Code

HCLT.BO

revenues are expected to grow between 10.5-12.5% in CC, while Operating Margin

Bloomberg Code

HCLT@IN

(EBIT) is expected to be in the range of 19.5-20.5%. We maintain our Buy rating.

Quarterly highlights: The sales came in at US$1,884mn (v/s. US$1,891mn expected)

v/s. US$1,817mn in 4QFY2017, a qoq growth of 3.7% qoq. Revenue in Constant

Shareholding Pattern (%)

Currency was up 2.6% qoq. The growth in terms of geography was driven by the USA

Promoters

59.9

and ROW, which posted a qoq CC growth of 3.8% and 3.1% respectively. Europe on

MF / Banks / Indian Fls

11.0

the other hand posted a CC qoq dip of 0.4%. In terms of the services, it was

FII / NRIs / OCBs

26.0

Engineering and R&D Services which posted a CC qoq of 7.9%. In terms of verticals,

Indian Public / Others

3.1

the financial services posted a qoq CC growth of 5.3%; Life sciences & Healthcare

posted a qoq CC growth of 4.8%, while Retail & CPG posted a qoq CC growth of

4.9%. On the operating profit front, the EBIT came in at 20.1% (v/s. 19.5% expected)

Abs.(%)

3m

1yr

3yr

v/s. 20.0% in 4QFY2017, a qoq expansion of 8bps. Thus, PAT came in at `2,171cr

Sensex

8.1

15.7

24.6

(v/s. `2,101cr expected) v/s. `2,325cr in 4QFY2017, a qoq dip of 6.6%.

HCL Tech

8.8

19.7

10.5

Outlook and valuation: We expect HCL Tech to post a USD and INR revenue CAGR of

10.7% and 10.7% respectively over FY2017-19E. On the back of strong order book and

given the attractive valuations, we recommend a Buy on the stock.

3-year price chart

Key financials (Consolidated, US GAAP)

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

Net sales

30,781

46,723

52,342

57,053

% chg

(16.9)

51.8

12.0

9.0

Net profit

5,643

8,457

8,860

9,536

% chg

(22.2)

49.9

4.8

7.6

EBITDA margin (%)

21.5

22.1

20.9

20.9

EPS (`)

40.0

60.0

62.8

67.6

P/E (x)

22.3

14.9

14.2

13.2

P/BV (x)

4.5

3.8

3.2

2.7

Source: Company, Angel Research

RoE (%)

20.1

25.3

22.4

20.6

Sarabjit kour Nangra

RoCE (%)

15.6

20.4

18.3

17.3

+91 22 3935 7800 Ext: 6806

EV/Sales (x)

3.8

2.5

2.1

1.8

EV/EBITDA (x)

17.6

11.1

10.0

8.7

Source: Company, Angel Research; Note: CMP as of July 26, 2017

Please refer to important disclosures at the end of this report

1

HCL Technologies | 1QFY2018 Result Update

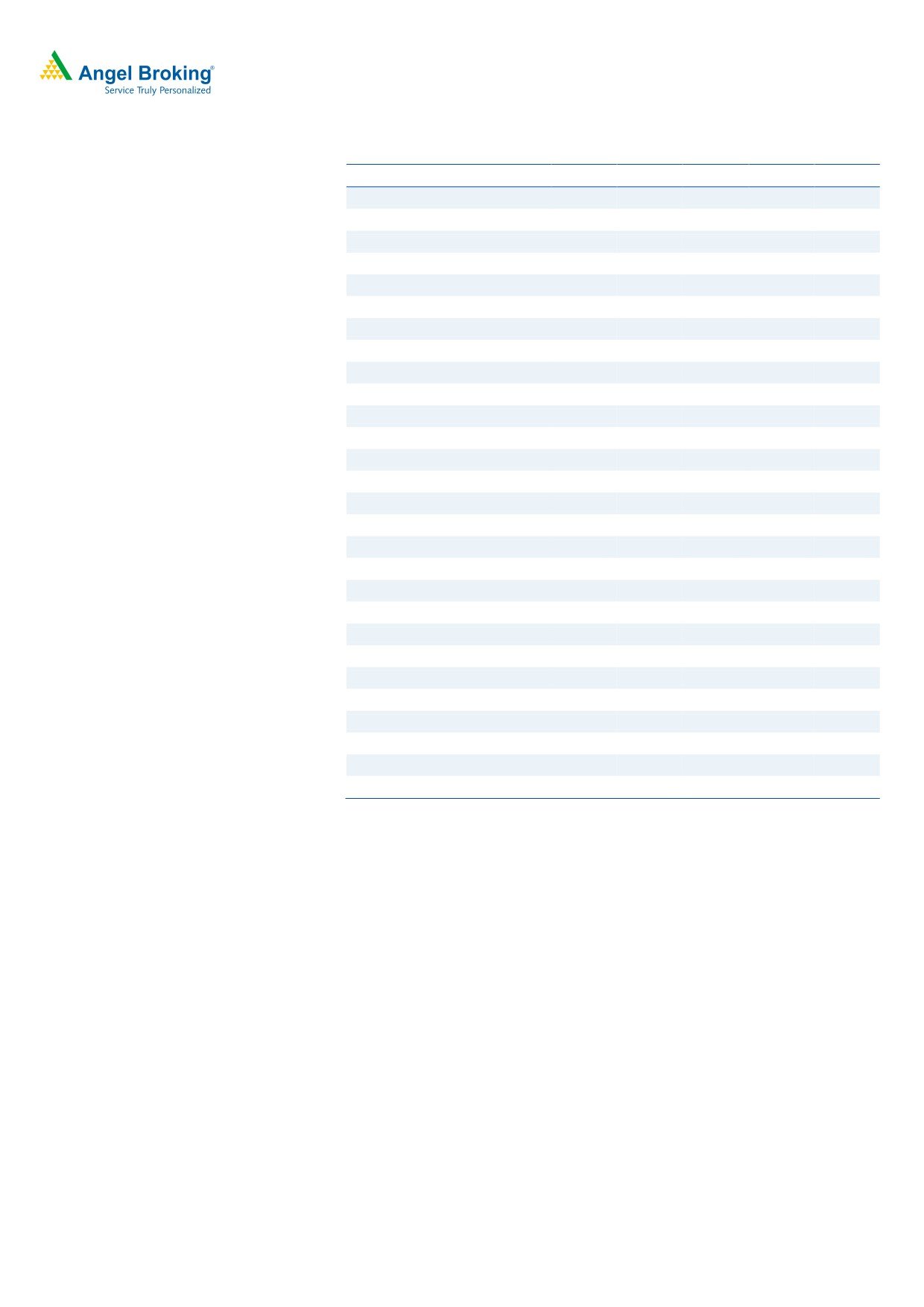

Exhibit 1: 1QFY2018 performance (Consolidated, US GAAP)

Y/E March (` cr)

1QFY18

4QFY17

% chg (qoq)

1QFY17

% chg (yoy)

FY17

FY16

% chg(yoy)

Net revenue

12,149

12,053

0.8

11,336

7.2

46,723

40,913

14.2

Cost of revenue

8,057

7,987

0.9

7,440

8.3

30,890

26,901

14.8

Gross profit

4,092

4,066

0.6

3,896

5.0

15,833

14,012

13.0

SG&A expense

1,411

1,417

(0.4)

1,375

2.6

5,524

5,217

5.9

EBITDA

2,681

2,649

1.2

2,521

6.3

10,309

8,795

17.2

Dep. and

236

233

1.3

188

25.5

835

569

46.7

amortization

EBIT

2,445

2,416

1.2

2,333

4.8

9,474

8,226

15.2

Other income

269

215

25.1

253

6.3

934

1,009

(7.4)

PBT

2,714

2,631

3.2

2,586

4.9

10,408

9,235

12.7

Income tax

543

303

79.2

543

-

1,952

1,883

3.7

PAT

2,171

2,325

(6.6)

2,047

6.1

8,456

7,352

15.0

Forex gain/(loss)

-

-

-

-

-

-

Adjusted PAT

2,171

2,325

(6.6)

2,047

6.1

8,456

7,352

15.0

EPS

15.4

16.5

(6.6)

14.5

6.1

60.0

52.1

15.0

Gross margin (%)

33.7

33.7

(5)bp

34.4

(69)bps

33.9

34.2

(36)bp

EBITDA margin (%)

22.1

22.0

9bp

22.2

(17)bps

22.1

21.5

57bp

EBIT margin (%)

20.1

20.0

8bp

20.6

(46)ps

20.3

20.1

17bp

PAT margin (%)

17.9

19.3

(142)bp

18.1

(19)bps

18.1

18.0

13bp

Source: Company, Angel Research, Note-FY2016 is 12month results for meaningful comparison, From FY2017, company has March ending company

Exhibit 2: 1QFY2018 - Actual Vs Angel estimates

(` cr)

Actual

Estimate

Variation (%)

Net revenue

12,149

12,208

(0.5)

EBIDTA margin (%)

22.1

21.4

67bp

PAT

2,171

2,101

3.3

Source: Company, Angel Research

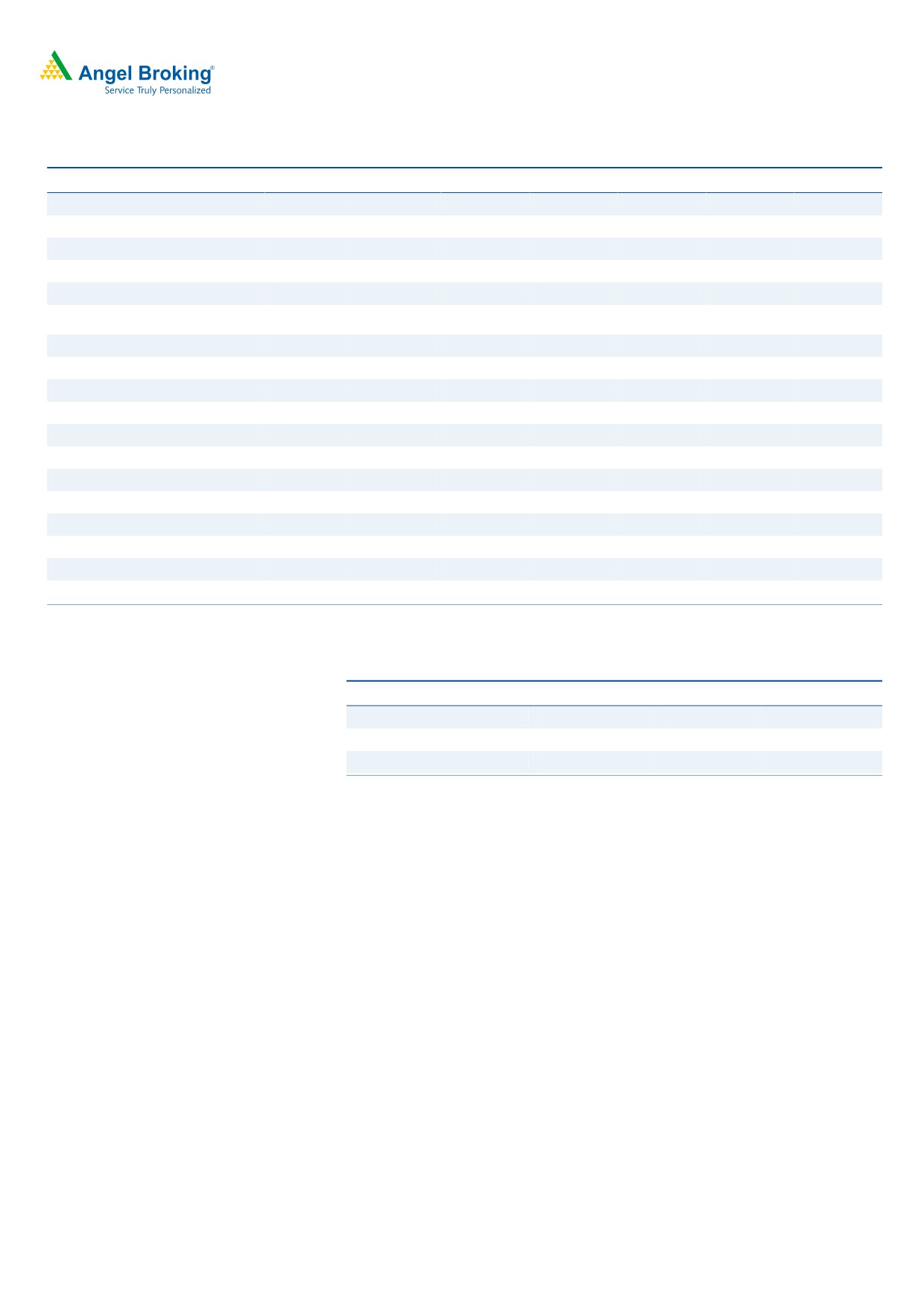

Sales just in-line with expectation

The sales, came in at US$1,884mn (v/s. US$1,891mn expected) v/s. US$1,817mn

in 4QFY2017, a qoq growth of 3.7% qoq. In Rupee terms, the sales came in at

`12,149 (v/s. `12,208cr expected) v/s. `12,053cr in 4QFY2017, a qoq growth of

0.8%. Revenue in Constant Currency was up 2.6% qoq.

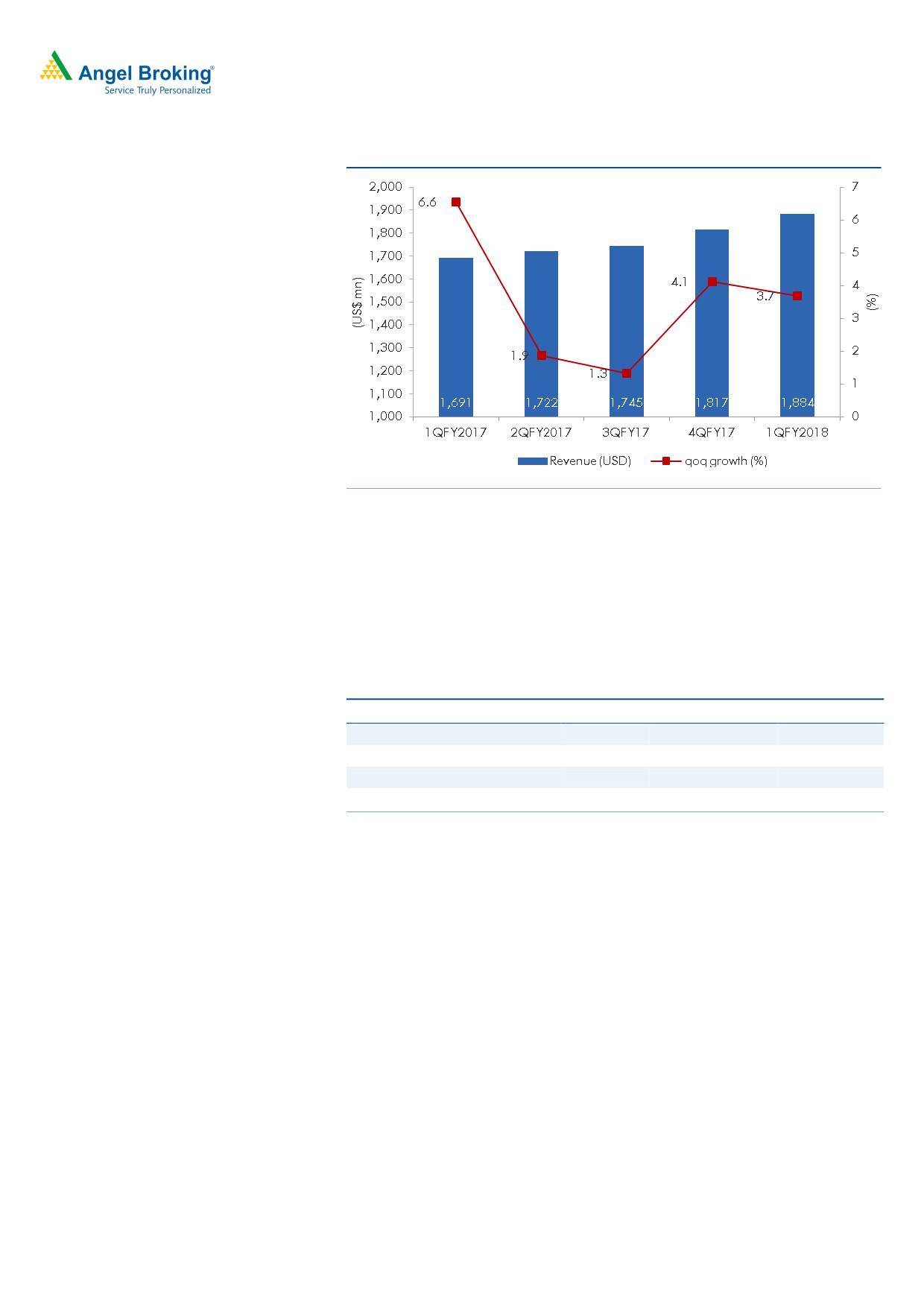

The growth in terms of geography was driven by the USA and ROW, which posted

a qoq CC growth of 3.8% and 3.1% respectively. Europe on the other hand posted

a CC qoq dip of 0.4%. In terms of the services, it was Engineering and R&D

Services which posted a CC qoq of 7.9%. In terms of verticals, the financial

services posted a qoq CC growth of 5.3%, Life sciences & Healthcare posted a qoq

CC growth of 4.8%, while Retail & CPG posted a qoq CC growth of 4.9%.

July 28, 2017

2

HCL Technologies | 1QFY2018 Result Update

Exhibit 3: Revenue growth trend

Source: Company, Angel Research

In terms of services, Engineering & R&D services (which constituted 21.5% of sales)

posted a growth of 7.9% qoq (CC), while Application services (accounting for

36.3% of sales) grew by 1.6% qoq (CC). Infrastructure services, another important

segment of the company, which contributes around 38.6% to overall sales, posted

a growth of 1.7% qoq (CC). Business services, which constituted 3.6% of sales, de-

grew by 6.7% qoq (CC).

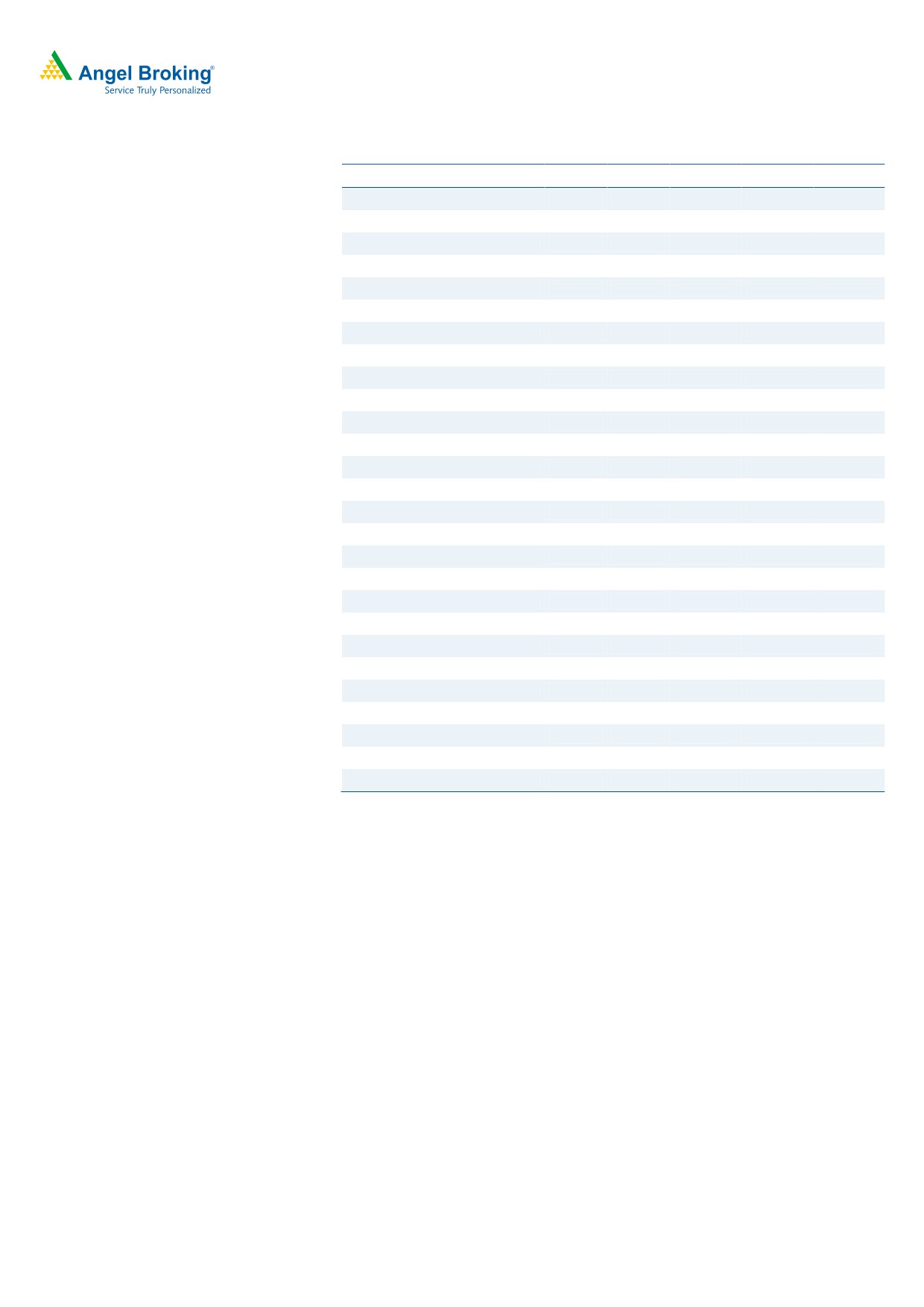

Exhibit 4: Revenue growth trend (Service wise)

% of revenue

% growth CC (qoq)

% growth (yoy)

Application services

36.3

1.6

6.3

Infrastructure services

38.6

1.7

22.7

Business services

3.6

(6.7)

(10.6)

Engineering and R&D services

21.5

7.9

19.4

Source: Company, Angel Research

Industry segment wise, the company’s Financial Services vertical (contributing

24.9% to revenue) posted a 5.3% qoq growth in CC terms. The Manufacturing

vertical (contributing 34.9% to revenue) posted a 3.3% qoq growth in CC terms.

Public services, Life sciences & Healthcare, and Telecommunication, Media,

Publishing & Entertainment reported a qoq growth of (2.7)%, 4.8% and (2.5)%, all

in CC terms, respectively. Retail & CPG (contributing 9.5% of the revenue), on the

other hand, reported a growth of 4.9% qoq CC terms during the quarter.

July 28, 2017

3

HCL Technologies | 1QFY2018 Result Update

Exhibit 5: Revenue growth trend (Industry wise)

% of revenue

% growth (CC qoq)

% growth (yoy)

Financial services

24.9

5.3

9.3

Manufacturing

34.9

3.3

18.2

Life sciences & Healthcare

11.8

4.8

11.8

Public Services

11.1

(2.7)

22.5

Retail & CPG

9.5

4.9

16.0

Telecom, MPE

7.9

(2.5)

3.4

Source: Company, Angel Research

Among geographies, in CC terms, America grew by 3.8% qoq, RoW grew by 3.1%

qoq, while Europe de-grew by 0.4% qoq, during the period.

Exhibit 6: Revenue growth trend (Geography wise in CC terms)

Source: Company, Angel Research

Hiring and utilization

During the quarter, the overall headcount of HCL Tech increased by 10,752 to

1,17,781 employees. The attrition rate in IT Services inched downwards to 16.2%

(v/s. 16.9% in 4QFY2017) and the blended utilization level of the company inched

up to 86.0% (v/s. 85.7% in 4QFY2017).

Exhibit 7: Hiring trend

Particulars

1QFY17

2QFY17

3QFY17

4QFY17

1QFY18

Technical

98,225

99,897

1,01,154

1,05,547

1,07,029

Support

9,743

9,898

9,938

10,426

10,752

Total employee base

107,968

109,795

1,11,092

1,15,973

1,17,781

Gross addition

10,515

9,083

8,467

10,605

9,462

Net addition

3.072

2,097

3,124

6,178

1,808

Attrition - IT services (LTM) - %

17.8

18.6

17.9

16.9

16.2

Source: Company, Angel Research

July 28, 2017

4

HCL Technologies | 1QFY2018 Result Update

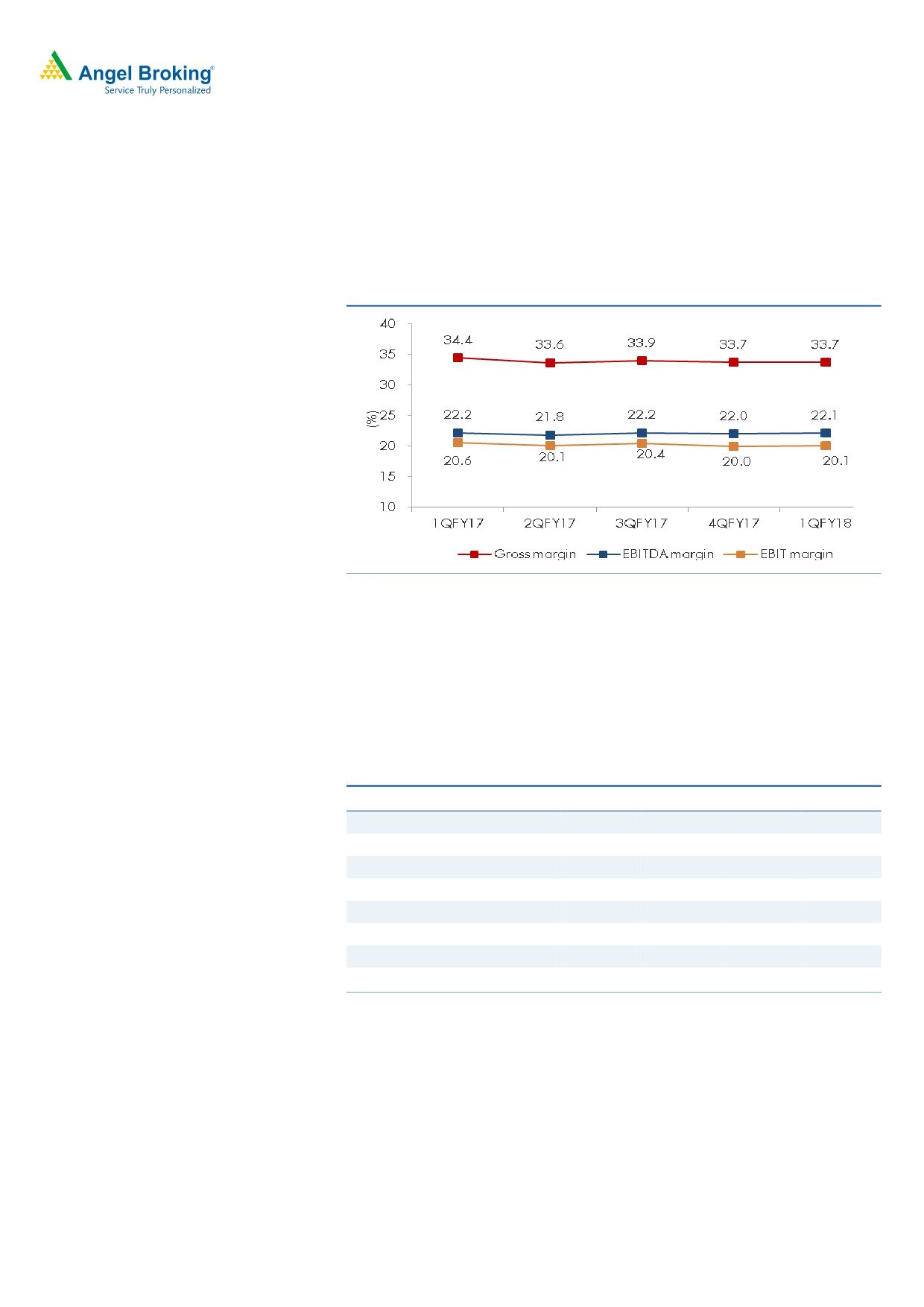

Operating margin better then expectation

On the operating front, the EBDITA margins came in at 22.1% (v/s. 22.0% in

4QFY2017), a qoq expansion of 9bps, while the EBIT margins came in at 20.1%,

a qoq expansion of 8bps. This was against the EBDITA & EBIT margin expectations

of 21.4% & 19.5% respectively.

Exhibit 8: Margin profile

Source: Company, Angel Research

Client pyramid

The company signed

13 transformational deals this quarter. These deals

represented a well-balanced mix across service lines, industry verticals and

geographies. Company added

1 client in the US$50+mn and

2 in the

US$40+mn.

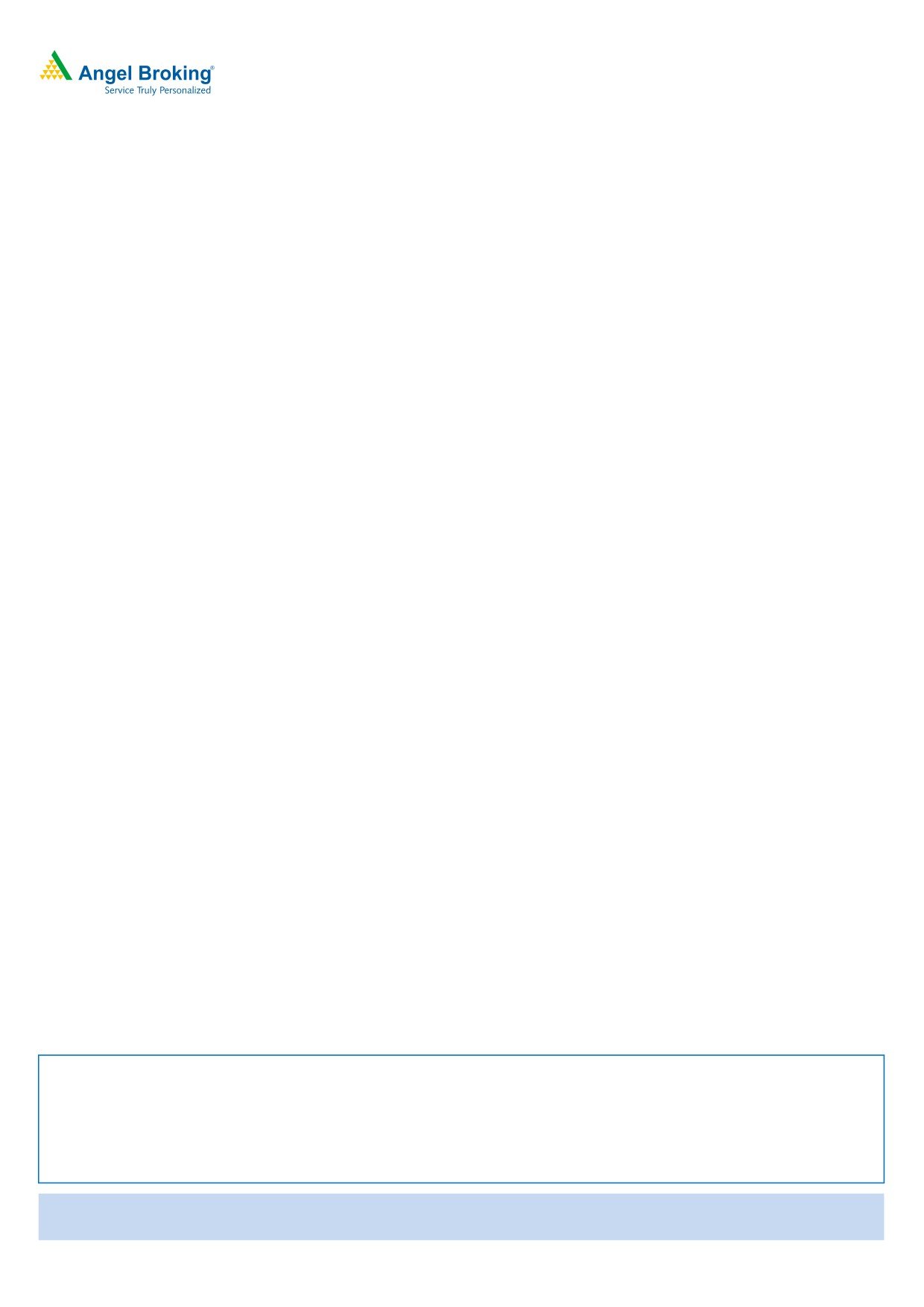

Exhibit 9: Client pyramid

Particulars

1QFY17

2QFY17

3QFY17

4QFY17

1QFY18

US$1mn-5mn

262

245

259

260

259

US$5mn-10mn

84

91

89

93

95

US$10mn-20mn

49

66

64

68

68

US$20mn-30mn

35

32

33

36

34

US$30mn-40mn

16

16

15

15

17

US$40mn-50mn

5

12

14

9

10

US$50mn-100mn

10

13

12

17

17

US$100mn plus

7

7

8

8

8

Source: Company, Angel Research

July 28, 2017

5

HCL Technologies | 1QFY2018 Result Update

Investment arguments

Robust outlook re-titrated for FY2018: On the basis of deals on hand, the

company gave a revenue growth guidance of 10.5-12.5% in CC for FY2018,

which includes a component of inorganic growth, adjusting for which, the organic

growth would be 7.5-9.5% in CC for FY2018. The operating margin (EBIT) for

FY2018 is expected to be in the range of 19.5-20.5%. We expect HCL Tech to post

a USD and INR revenue CAGR of 10.7% and 10.7% respectively, over FY2017-

19E (inclusive of the acquisition of Geometric Software and Volvo deals).

Healthy pipeline: HCL Tech signed 8 transformational deals this quarter, across

service lines and industry verticals. The broad-based business wins were driven by

next-generation integrated offerings - Next-Gen ITO, BEYONDigital, and IoT

WoRKS, reflecting investments in Internet of Things, digital technologies, cloud,

automation and artificial intelligence.

The company signed

13 transformational deals this quarter. These deals

represented a well-balanced mix across service lines, industry verticals and

geographies. Company added

1 client in the US$50+mn and

2 in the

US$40+mn.

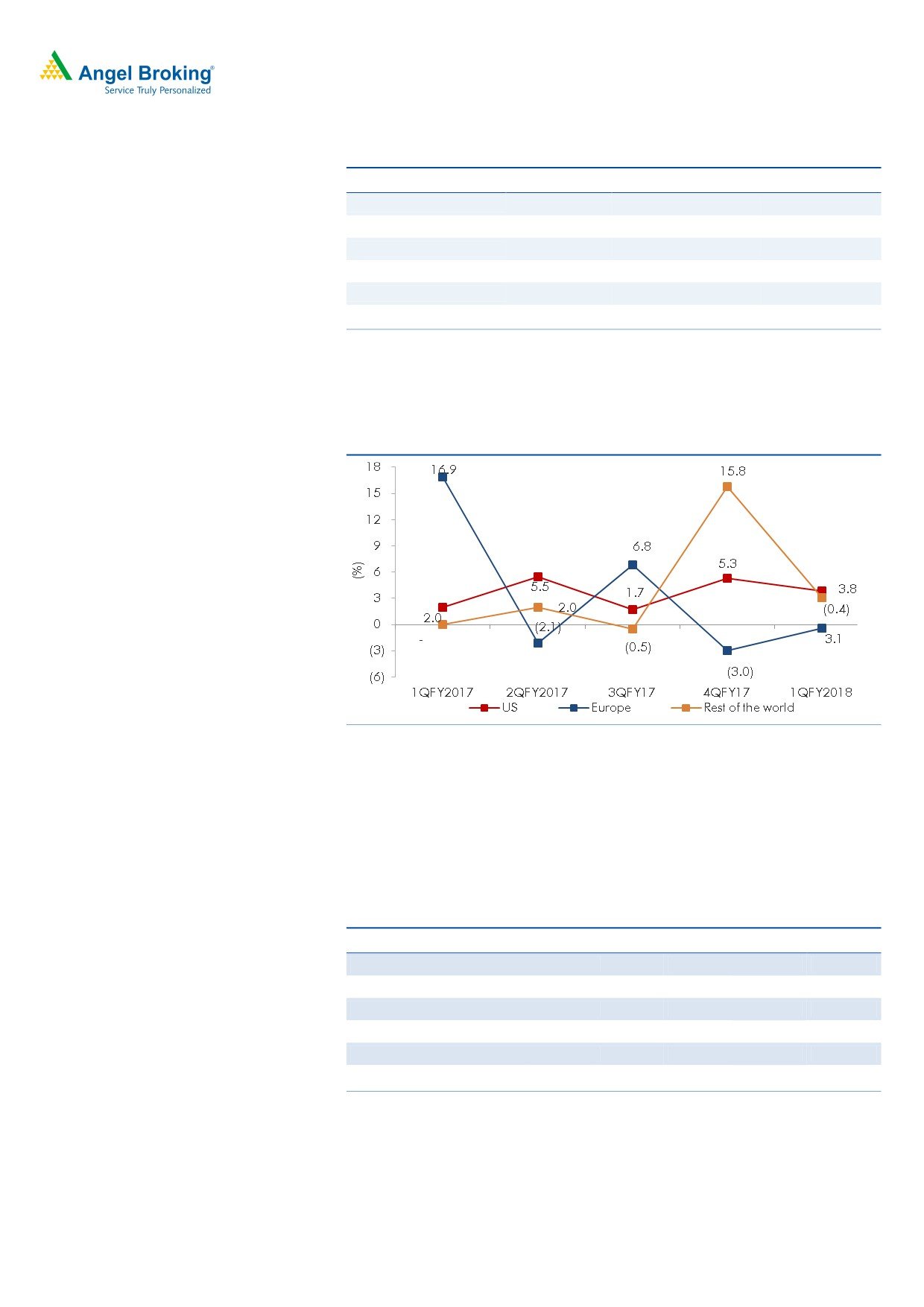

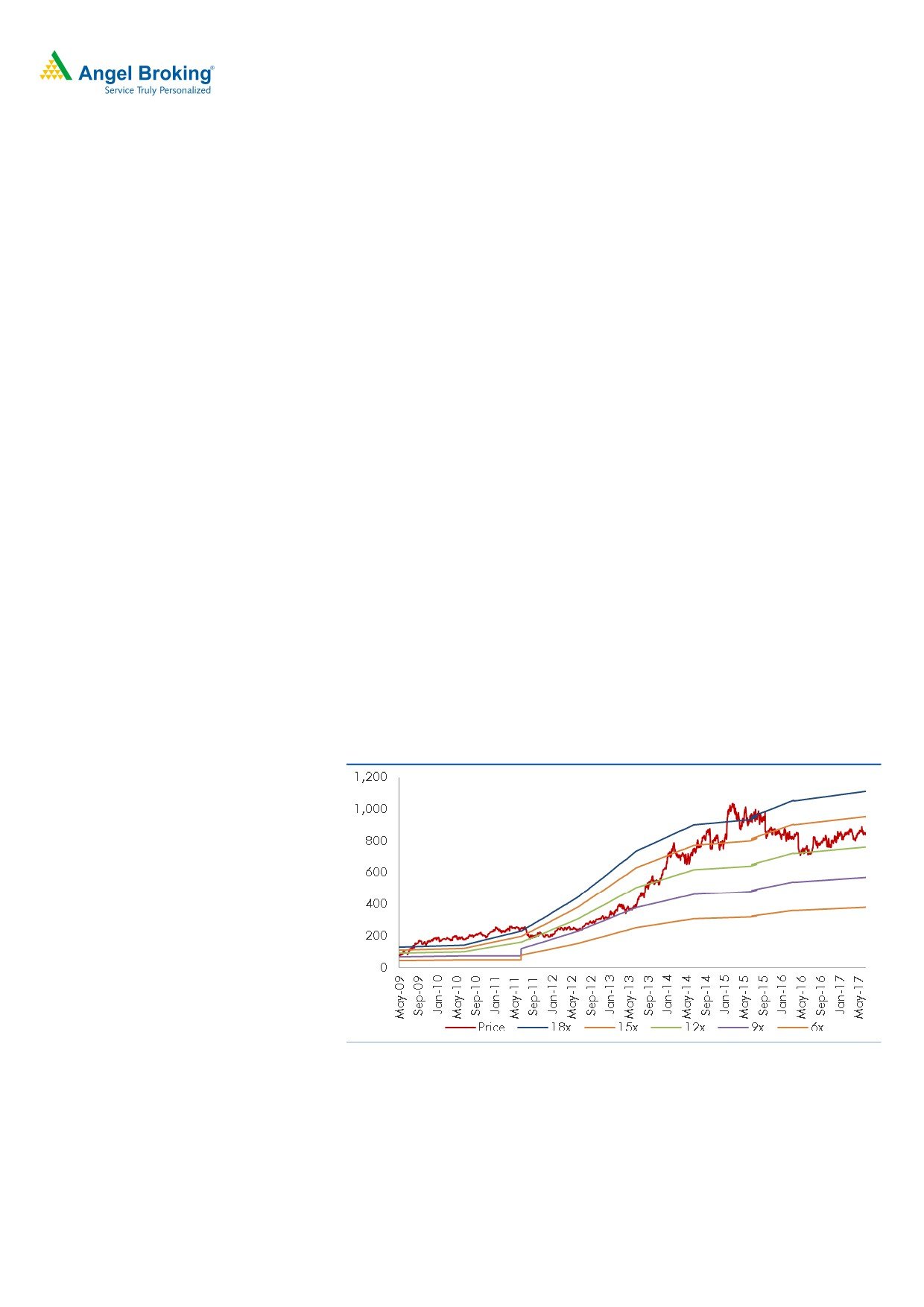

Outlook and valuation

On the operating front, HCL Tech’s EBIT margin had been around 19.3% in

FY2017, a dip of 1,000bps over the previous financial year. We expect the EBIT

and PAT to post a 7.9% and 7.1% CAGR respectively over FY2017-19E. At the

current market price, the stock is trading at 14.2x FY2018E and 13.2x FY2019E

EPS. We recommend a Buy, with a price target of `1,014.

Exhibit 10: One-year forward PE (x) chart

Source: Company, Angel Research

July 28, 2017

6

HCL Technologies | 1QFY2018 Result Update

Exhibit 11: Recommendation summary

Company

Reco

CMP

Tgt Price

Upside

FY2019E

FY2019E

FY2017-19E

FY2019E

FY2019E

(`)

(`)

(%)

EBITDA (%)

P/E (x)

EPS CAGR (%)

EV/Sales (x)

RoE (%)

HCL Tech

Accumulate

891

1,014

13.7

20.9

13.2

6.2

1.8

20.6

Infosys

Buy

994

1,179

18.6

26.0

14.3

5.3

2.2

19.6

TCS

Neutral

2,555

-

-

27.6

16.4

7.8

3.1

29.8

Tech Mahindra

Buy

389

533

37.0

15.0

10.2

8.6

1.1

16.3

Wipro

Neutral

290

-

-

20.3

15.2

4.4

1.2

13.4

Source: Company, Angel Research

Company Background

HCL Tech is India's fifth largest IT services company, with over

1,00,000

employees catering to more than 450 clients. The company's service offerings

include Enterprise Application Services (EAS), Custom Applications, Engineering

Research & Development (ERD), and Infrastructure Management Services (IMS). In

December 2008, HCL Tech acquired UK-based SAP consulting company - Axon,

which now contributes

~10% to its consolidated revenue. Recently, during

3QFY2016, the company acquired Geometric Software.

July 28, 2017

7

HCL Technologies | 1QFY2018 Result Update

Profit and loss statement (Consolidated, US GAAP)

Y/E Mar (` cr)

FY2015

FY2016

FY2017

FY2018E

FY2019E

Net sales

37,061

30,781

46,723

52,342

57,053

Cost of revenues

23,798

20,235

30,890

34,598

37,712

Gross profit

13,263

10,546

15,833

17,744

19,341

% of net sales

35.8

34.3

33.9

33.9

33.9

SG&A expenses

4,563

3,940

5,524

6,804

7,417

% of net sales

12.3

12.8

11.8

13.0

13.0

EBITDA

8,700

6,606

10,309

10,939

11,924

% of net sales

23.5

21.5

22.1

20.9

20.9

Depreciation and amort.

451

393

835

935

1085

% of net sales

1.2

1.3

1.8

1.8

1.9

EBIT

8,249

6,213

9,474

10,004

10,839

% of net sales

22.3

20.2

20.3

19.1

19.0

Other income, net

912

756

934

934

934

Profit before tax

9,161

6,969

10,408

10,938

11,773

Provision for tax

1,908

1,364

1,952

2,078

2,237

% of PBT

20.8

19.6

18.8

19.0

19.0

PAT

7,253

5,605

8,457

8,860

9,536

Share from equity invest.

-

-

-

-

-

Forex loss

-

-

-

-

-

ESOP charges

103

38

-

-

-

Reported net profit

7,253

5,643

8,457

8,860

9,536

Fully diluted EPS (`)

51.4

40.0

60.0

62.8

67.6

Note: FY2016 Numbers are 9 month figures

July 28, 2017

8

HCL Technologies | 1QFY2018 Result Update

Balance sheet (Consolidated, US GAAP)

Y/E Mar (` cr)

FY2015

FY2016

FY2017

FY2018E

FY2019E

Cash and cash equivalent

1,352

729

1,317

1,500

1,700

Account receivables, net

6,563

7,721

8,301

9,039

9,853

Unbilled receivables

2,923

3,002

2,501

3,141

3,423

Deposit with banks

9,670

10,587

10,220

14,102

20,059

Deposit (one year with HDFC ltd)

-

-

-

-

-

Invest. securities, available for sale

767

537

1,146

2,250

2,251

Other current assets

2,338

2,410

2,983

3,283

3,583

Total current assets

23,613

24,986

26,468

33,315

40,870

Property and equipment, net

3,820

4,323

4,681

4,981

5,281

Intangible assets, net

5,204

6,419

11,426

11,426

11,426

Deposits with HDFC Ltd.

-

-

-

-

-

Fixed deposits with banks

-

-

-

-

-

Investment securities HTM

8

160

147

147

147

Investment in equity investee

-

-

-

-

-

Other assets

3,066

3,879

3,712

4,780

4,780

Total assets

35,711

39,768

46,432

54,648

62,502

Current liabilities

9,232

9,509

11,148

12,483

13,606

Borrowings

469

973

542

542

542

Other liabilities

1,259

1,264

1,253

2,078

2,078

Total liabilities

10,960

11,745

12,942

15,103

16,226

Minority interest

-

-

-

-

Total stockholder equity

24,751

28,022

33,490

39,545

46,276

Total liab. and stock holder equity

35,711

39,767

46,432

54,648

62,502

Note: FY2016 Numbers are 9 month figures

July 28, 2017

9

HCL Technologies | 1QFY2018 Result Update

Cash flow statement (Consolidated, US GAAP)

Y/E Mar (` cr)

FY2015

FY2016

FY2017

FY2018E FY2019E

Pre tax profit from operations

7,253

5,643

8,457

8,860

9,536

Depreciation

451

393

835

935

1,085

Expenses (deffered)/written off/others

(168)

(48)

(48)

(48)

(48)

Pre tax cash from operations

7,536

5,988

9,244

9,747

10,573

Other income/prior period ad

912

756

934

934

934

Net cash from operations

8,448

6,744

10,178

10,681

11,507

Tax

(1,908)

(1,364)

(1,952)

(2,078)

(2,237)

Cash profits

6,540

5,381

8,226

8,603

9,270

(Inc)/dec in current assets

(1,991)

(1,309)

(653)

(1,677)

(1,396)

Inc/(dec) in current liabilties

1,035

277

1,639

1,335

1,123

Net trade working capital

(956)

(1,033)

987

(342)

(273)

Cashflow from operating activities

5,584

4,348

9,213

8,261

8,998

(Inc)/dec in fixed assets

(674)

(503)

(358)

(300)

(300)

(Inc)/dec in intangibles

(55)

(1,215)

(5,006)

-

-

(Inc)/dec in investments

(1,458)

(687)

(242)

(4,987)

(5,958)

(Inc)/dec in minority interest

-

-

-

-

-

Inc/(dec) in non current liabilities

(203)

5

(11)

-

-

(Inc)/dec in non current assets

(214)

(72)

(573)

(300)

(300)

Cashflow from investing activities

(2,602)

(2,473)

(6,189)

(5,587)

(6,558)

Inc/(dec) in debt

-

-

-

-

-

Inc/(dec) in equity/premium

-

-

-

-

-

ESOP charges

(103)

(103)

(103)

(103)

(103)

Dividends

(1,651)

(2,805)

(2,805)

(2,805)

(2,805)

Others

(208)

2,385

614

1,551

1,969

Cashflow from financing activities

(1,962)

(523)

(2,294)

(1,357)

(939)

Cash generated/(utilised)

331

(623)

587

184

200

Cash at start of the year

1,021

1,352

729

1,317

1,500

Cash at end of the year

1,352

729

1,317

1,500

1,700

Note: FY2016 Numbers are 9 month figures

July 28, 2017

10

HCL Technologies | 1QFY2018 Result Update

Key ratios

Y/E Mar

FY2015

FY2016

FY2017

FY2018E

FY2019E

Valuation ratio (x)

P/E (on FDEPS)

17.3

22.3

14.9

14.2

13.2

P/CEPS

16.3

20.8

13.5

12.8

11.8

P/BVPS

5.1

4.5

3.8

3.2

2.7

Dividend yield (%)

1.6

1.9

1.9

1.9

1.9

EV/Sales

3.1

3.8

2.5

2.1

1.8

EV/EBITDA

13.3

17.6

11.1

10.0

8.7

EV/Total assets

3.2

2.9

2.5

2.0

1.7

Per share data (`)

EPS (Fully diluted)

51.4

40.0

60.0

62.8

67.6

Cash EPS

54.6

42.8

65.9

69.4

75.3

Dividend

14.0

17.0

17.0

17.0

17.0

Book value

175

199

237

280

328

Dupont analysis

Tax retention ratio (PAT/PBT)

0.8

0.8

0.8

0.8

0.8

Cost of debt (PBT/EBIT)

1.1

1.1

1.1

1.1

1.1

EBIT margin (EBIT/Sales)

0.2

0.2

0.2

0.2

0.2

Asset turnover ratio (Sales/Assets)

1.0

0.8

1.0

1.0

0.9

Leverage ratio (Assets/Equity)

1.4

1.4

1.4

1.4

1.4

Operating ROE

29.3

20.0

25.3

22.4

20.6

Return ratios (%)

RoCE (pre-tax)

23.1

15.6

20.4

18.3

17.3

Angel RoIC

34.5

22.4

28.2

27.3

28.3

RoE

29.3

20.1

25.3

22.4

20.6

Turnover ratios (x)

Asset turnover (fixed assets)

10.6

7.6

10.4

10.8

11.1

Receivables days

68

83

78

67

66

Note: FY2016 Numbers are 9 month figures

July 28, 2017

11

HCL Technologies | 1QFY2018 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

HCL Technologies

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

July 28, 2017

12